The transition from volume-based to value-based care will have a monumental impact on what it means to be competitive in healthcare. There’s a growing interest in the convenience of digital communication, patient payment plans, and more options for paying healthcare bills online with an increasing financial responsibility falling on patients' shoulders.

Why Offer Patient Payment Plans?

Patient expectations have shifted greatly towards the convenience and affordability of online payment plans. Many practices offer options for payment plans which increase the percentage of upfront payments and allow patients who can’t afford paying the full bill all at once greater control over their monthly healthcare costs. Furthermore, patients are more loyal towards practices with more convenient services like payment plans.

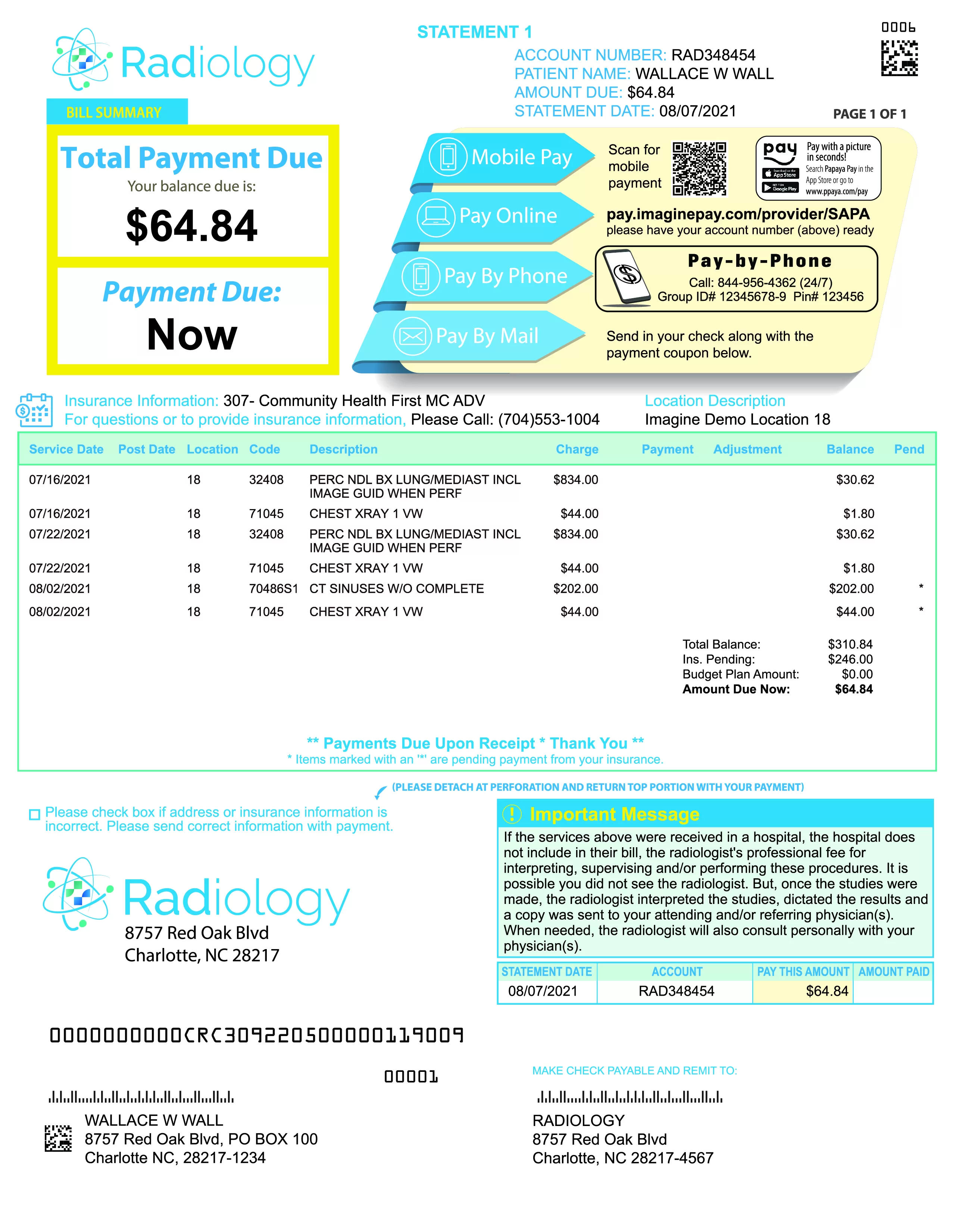

Options for Online Patient Payments

In a 2016 InstaMed report, research found 68% of consumers prefer electronic payment methods for paying medical bills, while 80% prefer to pay their health plan premiums online. Popular online patient payment options include:

- Online Patient Portal - signing up via credit card or ACH where money is auto-drafted from a patient's account in smaller payments over time

- Patient Financing - often provided through a bank or money lender

- Interest-free Payment Plans - where a hospital will work with a vendor to offer 0-interest credit lines and a set timeframe in which patients may pay their medical bill.

1. New Regulations Supporting Better Patient Payment Solutions

Consumer protection and transparency have always been a hot topic in healthcare; more so with trends in high deductible health plans. For example, the Rhode Island Senate passed a bill where if a patient and provider cannot agree on the cost of out-of-network procedures, the patient may only be responsible for paying the equivalent in-network costs. The bill also states that patients may request a written estimate of the overall costs prior to any procedure that they will be held liable to pay.

Some healthcare providers are pre-emptively moving towards providing estimates to patients before a procedure as they move towards providing value-based care. HIMSS Analytics conducted a 2018 study in which 46% of patients stated, “they’d be more likely to pay a bigger portion of their bill up front, before or during the time of service,” if they received a cost estimate upfront. 60% of patients who know upfront cost estimates to be an option stated they will ask for one in the future. Even with the demand for medical billing estimation, 87% of providers are not meeting the demand for such a service.

2. Market Trends and Technologies Changing the Way People Prefer to Pay

Companies large and small are using technology to rein in the cost of healthcare, making it easier for patients to stay on top of healthcare bills. A venture between Amazon, JP Morgan Chase, and Berkshire Hathaway is examining ways to improve the efficiency of the U.S. healthcare system by focusing on “simplified, high-quality and transparent healthcare” for their U.S. employees. The Linux Foundation is investing in blockchain to improve fraud detection and the exchange of clinic data. At Imagine, we are focusing on technologies including Artificial Intelligence and automation to reduce instances of denied claims and coding mistakes.

The 2016 InstaMed report states, “Electronic and automated payment channels will become the norm in healthcare payments.” We aren’t the first industry affected by new consumer preferences amongst shifting industry standards. Historically, financial services and healthcare providers have relied on a volume-based business model where more focus is placed on increasing transactions in pursuit of greater value. Following the Great Recession, standards for transparency and customer expectations dramatically changed in the financial services industry. This, combined with online encryption and PCI standards, opened up new opportunities for online methods of payment.

3. The Business Case for Patient Payment Plans

The way people prefer to pay is changing. Online payment options are quickly becoming the norm in the same way that PayPal or an online banking portal are changing the way people pay bills. In addition to a patient payment portal, some practices have begun offering automated patient payment plans instead of credit lines. These credit lines often come with unexpected long-term costs not immediately apparent to the patient.

HonorCare® is an affordable payment option, without the risk of loan management or debt collection.

While cost is certainly a factor in customer satisfaction, the assumption is that patients will develop a preference for practices that work towards convenience (note - patients are 5X more likely to refer friends and family to healthcare providers whom they feel loyalty towards.) With increasing diversification in healthcare financing options and more of the financial burden falling on consumers, practices who don’t adopt new technologies like online billing payment options and patient payment plans will find it increasingly difficult to be successful.