Originally published July 03, 2018

Managing the billing landscape can be challenging for medical practices and other healthcare providers. The transition to value-based care and rising patient responsibility make the management of day-to-day operations even more complex. However, providers that regularly measure the financial health of their practice and ensure their staff is performing at peak efficiency can achieve a wealth of advantages, both financial and operational.

One of the primary methods physician practices should employ to examine and identify the strengths and weaknesses of their revenue cycle is by tracking medical billing performance metrics. These revenue cycle key performance indicators (KPIs) can help providers prioritize resources, recognize drivers of success and guide future operational decisions.

Important Revenue Cycle Key Performance Indicators

The HFMA describes revenue cycle KPIs as well-defined metrics that illustrate performance, KPIs aid in highlighting and comparing key quality improvement and value metrics through analysis of real-time data. They enable providers to boost staff productivity, eliminate root causes for poor performance, increase patient satisfaction and promote proactive decision-making.

Are you interested in your own medical practice or billing company’s analytics? Learn more in our ebook, “7 Benefits of Using Healthcare Analytics.”

KPIs utilized by physician practices include net days in account receivable (A/R), percentage of claims denied, insurance A/R over 90 days, denials by procedure code, accuracy of department charge capture, percent of A/R greater than 90 days, late charges as a percentage of total charges, cost to collect and preregistration, insurance verification and service authorization rates. Although some provider practices might be overwhelmed by this comprehensive endeavor, starting with a focus on quality and tracking medical billing KPIs that will heavily impact their financial performance is recommended.

To help you get started, we’ve compiled a list of eight medical billing KPIs you should track on a daily, weekly or monthly basis. We’ve also included guidance on how to turn those numbers into actionable insights.

Daily and Weekly KPIs

- Cash Receipts: Revenue is the driving force of your business, so money that's collected and deposited should be monitored daily. Cash can't be benchmarked, but you can compare it to a previous period to ensure that cash flow is steady or improving. Keep in mind that this KPI can fluctuate greatly depending on things like the addition of new employees, new services, cancelled appointments and procedures and how quickly patients pay for their medical bills.

- Charges: This KPI should be monitoredclosely in conjunction with cash receipts. Because charges drive revenue, any fluctuation in charges will cause a fluctuation in cash. Divide total charges by 365 days to calculate your average daily charge amount.

- Payables: Knowing when your unpaid invoices are due and whether or not your practice has the cash to cover them in a timely manner is critical. The more you can track and improve your payables, the more lenient your vendor credit terms may be, which can save your practice a lot of money. Also, by monitoring this KPI, you can increase accounts payable process transparency and accountability among A/P staff.

Monthly KPIs

Two important healthcare accounts receivable KPIs that track how efficiently you're collecting payments from payers include days in receivables outstanding and receivables outstanding over 120 days. As a best practice, monitor these performance metrics every month to analyze what sources might be slowing your ability to realize revenue.

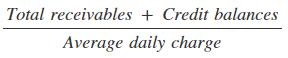

- Days in Receivables Outstanding (DRO): This is the average number of days it takes you to collect payments due to your practice. The calculation for DRO is:

You can certainly determine the average daily charge based on 365 days, but 90 days takes seasonality into account, as well as various fluctuations in business growth. So, how do you know if you're doing well? Here are the industry benchmarks for medical billing DRO:

High Performing Billing Department - 30 days or less

Average Performing Billing Department - 40-50 days

Below Average Performing Billing Department - 60 days or more

If your practice is hitting the below average mark or even the average performing, there are a lot of things you can do to improve your number. Analyze your back-end processes to ensure that you're avoiding duplicate billing, incorrect CPT modifiers, and inaccurate patient information that lead to more claim denials. Consider your patient payment process as well. Are you making it convenient for patients to pay their bills? Tools like an online patient payment portal and payment plans give patients the ability to pay for their medical expenses in a way that works for their budget. And bonus, they improve patient retention too!

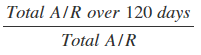

- Receivables Outstanding Over 120 Days: This is a great indicator of whether your patients and insurers are paying you in a timely manner. This KPI will also pinpoint claim denial timeliness issues and effectiveness of follow up on no-response claims. The calculation is:

A realistic number for which to aim is less than 12 percent. Choose a category, and stick to it for consistency. You can track this KPI in two ways. The first is by patients who are the new payers in healthcare. This calculation can be affected by eligibility verification, ways patients are paying for their bills and whether or not they have a clear understanding of how their insurance works. As with DRO, you can improve this number by analyzing and improving your patient payment process. The second way to track this medical billing performance metric is by insurer, which allows you to find out if your in-house billing staff or outsourced staff is tracking reimbursement and denials effectively.

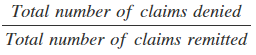

- Denial Rate: Claims denials cost healthcare organizations approximately five percent of their net revenue stream, which doesn’t include the $25 average for managing a denial. The Denial rate KPI tracks the percentage of denied claims and provides insight into how efficiently your claims process is operating. You can calculate your denial rate with the following:

The industry average denial rate is 5-10 percent, although under five is ideal. To improve your practice’s number, consider how much of your claims management process is manual. You can accelerate your collections performance with claims scrubbing, electronic remittance and auto coding/charge posting.

- Resolve Rate: This number is a great reflection of the overall effectiveness of your revenue cycle management (RCM) process, from eligibility to coding and billing. The calculation for resolve rate is:

The higher the percentage, the better. If your rate is high, it means your staff and the processes they follow are working effectively. Conversely, if your rate is low, examine your practice’s eligibility verification, coding, authorizations and credentialing. Providers spend about 71 minutes to rework a claim, so a low rate impacts both cash flow and staffing costs.

- Cash Collection as a Percentage of Net Patient Services Revenue: This medical billing performance metric is designed to evaluate a provider’s ability to transfer net patient services revenue to cash. You can develop this KPI with this calculation:

The collection goal should be, at a minimum, 100 percent of the provider’s monthly average net revenue for the preceding three months. When making this calculation, be sure to exclude patient-related settlements and payments, Medicare pass-through and Medicaid Disproportionate Share Hospital (DSH) payments. Also, avoid collecting patient service cash from ambulance services, post-acute services and physician practices and clinics unless they're recognized as a provider-based clinic by Medicare.

A Key Resource for Analyzing KPIs

By tracking KPIs, you have the capability to procure improved reimbursement, faster payment, less time spent on denials and appeals and an overall optimized revenue cycle. In order to be effective, they must be specific, achievable, measurable, actionable and relevant.

Even with guidance on how to improve these KPIs, it’s essential that you have the tools and resources to analyze them. The key is organizing your KPIs into dashboards through a business intelligence reporting and analytics tool. This will not only improve your ability to identify trends and patterns but also increase awareness around what variables impact your practice and enable you to easily share those findings with staff and management.

Receiving medical billing reports on a daily, weekly and monthly basis will enhance your ability to monitor financial performance by leaps and bounds. Keep in mind that these are only outcomes - a report won't improve them for you. Analyze your reports, ask questions, work closely with your billing department and help steer them in the right direction to improve KPIs and the practice as a whole.